Demographics and Lotteries

This article appeared in the October/November 2001 edition of Lottery Insights.

by David K. Foot

Almost all lotteries collect demographic information about their customers. The most common demographic data are the age and gender of the players, although ethnicity and location (city/rural) are receiving increasing attention. Other possibly relevant demographic attributes are education and marital status. These demographic data can be a potent tool to inform marketing or product strategies.

Age is probably the most important demographic variable for planning purposes. People's needs and interests change over their lifetimes as they move from starting their careers in their twenties to raising their families in their thirties and forties to dealing with empty nests and pre- retirement planning in their fifties and early sixties and to retirement in later ages. Therefore, age can be used to introduce a life cycle approach to marketing and product decisions.

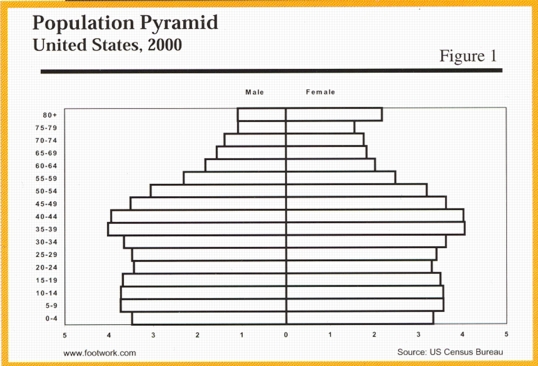

The dominant feature of American demographics has been the postwar Baby Boom (see Figure 1). As a result of peak fertility in the late 1950s, the most populous ages in the U.S. are currently in the 35 to 44 age group, so many lottery surveys find the most customers to be in this age group. Over the next decade lotteries should not be surprised to find that their customer base becomes older as the peak Boomers move into the 45 to 54 age group. This was followed by a bust of the birth bubble over the late 1960s and 1970s. By the late 1970s the Boomers were having their children resulting in an Echo Boom over the 1980s that continued into the early 1990s. The aging of this Boom, Bust & Echo profile has had profound effects on many sectors of the North American economy including lotteries.

Lotteries Figure 1

View larger version of Figure 1.

Market Penetration

While useful in summarizing the current lottery customer, demographics alone can provide misleading impressions about the success of various marketing strategies and lottery products. An effective marketing campaign targets market penetration, that is the proportion of the population purchasing a ticket over some prescribed period. This is equivalent to the probability that any individual participates in the game. Increasing this probability is the main objective of every marketing campaign. Since these probabilities vary by age, once again a life cycle approach can be instructive.

If, to take a hypothetical lottery, 35 to 44 year olds comprise 23 per cent of the adult population and 25 per cent of customers and 25 to 34 year olds comprise 18 percent of the adult population and 20 per cent of customers, then market penetration is actually higher in the younger group even though there are more customers in the older group. Put another way, there is a slightly higher probability that the 25 to 34 year old will buy a ticket than the 35 to 44 year old.

This conclusion can be verified by calculating a market penetration index which divides customer share by population share. In this hypothetical example, 25 divided by 23 (= 1.087) is lower than 20 divided by 18 (= 1.111). If age were collected at the point of sale, age based market penetration rates could be calculated accurately; without those data, penetration indices provide a useful surrogate measure of performance.

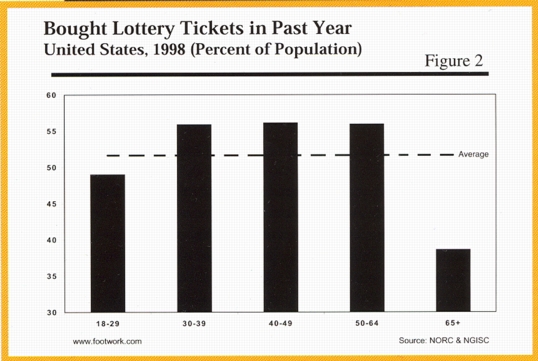

In fact in the U.S., lottery penetration (which is equivalent to customer participation) increases with age until the early fifties (Figure 2). Slightly more than one-half of the adult U.S. population bought at least one lottery ticket in the previous year, but not surprisingly, both the youngest (18 to 29) and oldest (65+) ages were below average.

Lotteries Figure 2

View larger version of Figure 2.

Lottery Spending

However, total dollar revenue, and hence net revenue, depends not only on the participation of customers, but also on how much they spend. This also varies by age. In the younger ages, incomes are generally lower and discretionary expenditures more limited, especially if there are mortgages to pay and children to raise. On average, with aging these constraints become gradually less severe so that by their fifties, customers have the maximum flexibility in discretionary spending. This is the golden period for lotteries. Retirement generally leads to lower incomes and lower expenditures.

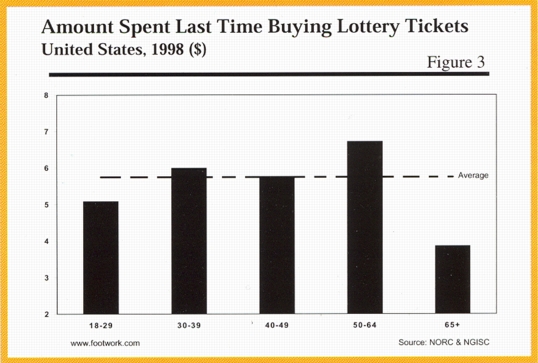

This spending pattern is verified by U.S. National Opinion Research Center (NORC) and National Gambling Impact Study Commission data (Figure 3). In 1998 the average American aged 50 to 64 spent $6.72 the last time they bought a lottery ticket whereas the average 18 to 29 year old spent $5.09 and the average senior $3.86.

Lotteries Figure 3

View larger version of Figure 3.

The movement of the massive postwar Boomer generation through its life cycle has had a profound impact on the lottery business. The first Boomer born in 1946 reached 18 in 1964, just when the first U.S. lottery appeared. Over the subsequent years, lotteries have grown up with the Boomers. Of course, new products and increasingly sophisticated marketing have played an important role, but without the rapid growth of the customer base, the past revenue growth would not have materialized.

Gender, Ethnicity and Product

Before looking into the future, it should be noted that a complete demographic analysis of lotteries could also disaggregate market penetration rates and age related purchases by gender and by ethnicity. This is especially important in target marketing any product. Other demographically related components may also be relevant, although these tend to be more important in niche marketing and less important in bigger picture analysis.

Another important age breakdown is by product or game type. The life cycle approach suggests that younger households with families are more likely to favor cheaper games while older pre-retired households without families at home are more likely to purchase higher priced ticket products. This may or may not be an accurate description in any individual lottery jurisdiction, but it does provide a useful overview within which to interpret the data.

The Future

The early Boomers are now entering the second half of their fifties. Over the next decade the peak Boomers will age from their early forties into their early fifties. Meanwhile, the children of the Boomers, the so called Echo Boom, will be in their twenties setting up their own households. The market is becoming fragmented. Growth will no longer be automatic. It will come to those lotteries that can best figure out the demographics of their catchment areas.

Demographic information can also be used for product planning. In this new millennium, two new products would seem to have the best potential for growth from a demographic perspective. First, higher priced products oriented towards the interests of Boomers in their fifties (such as gardening, bird watching, equities and travel rather than sports, except golf). Second, new relatively low priced electronic products with traditional themes (movies, sports, etc. ) geared towards the coming-of-age Echo children of the Boomers. The young have always been the champions of new technology and e-lotteries should be oriented to them. The potential for growth in this market is especially good in the southwest of the U.S. where the Echo Boomers are a larger share of the population.

Demographic information combined with a life cycle perspective provides a potent, forward looking tool to develop marketing and product strategies. All lotteries would be wise to integrate this information into their decision making as the North American customer base fragments into distinct segments in the new millennium.